FASTSTART FMS 2231-CGAUX 2005-2024 free printable template

Show details

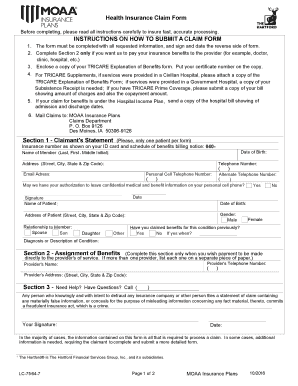

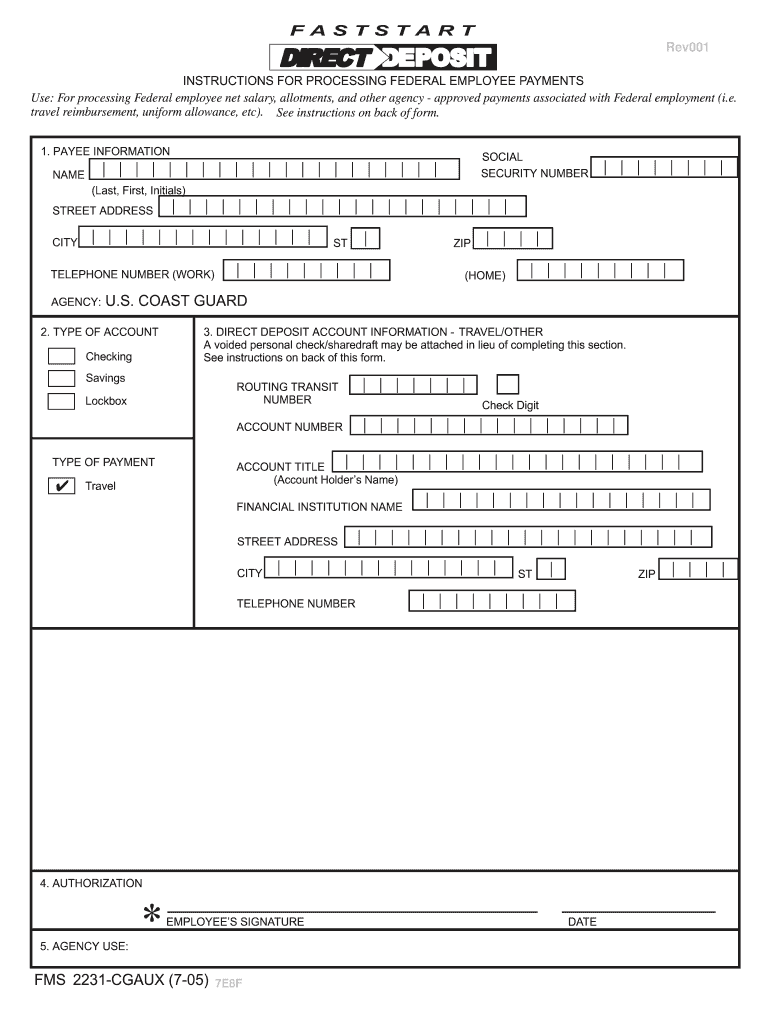

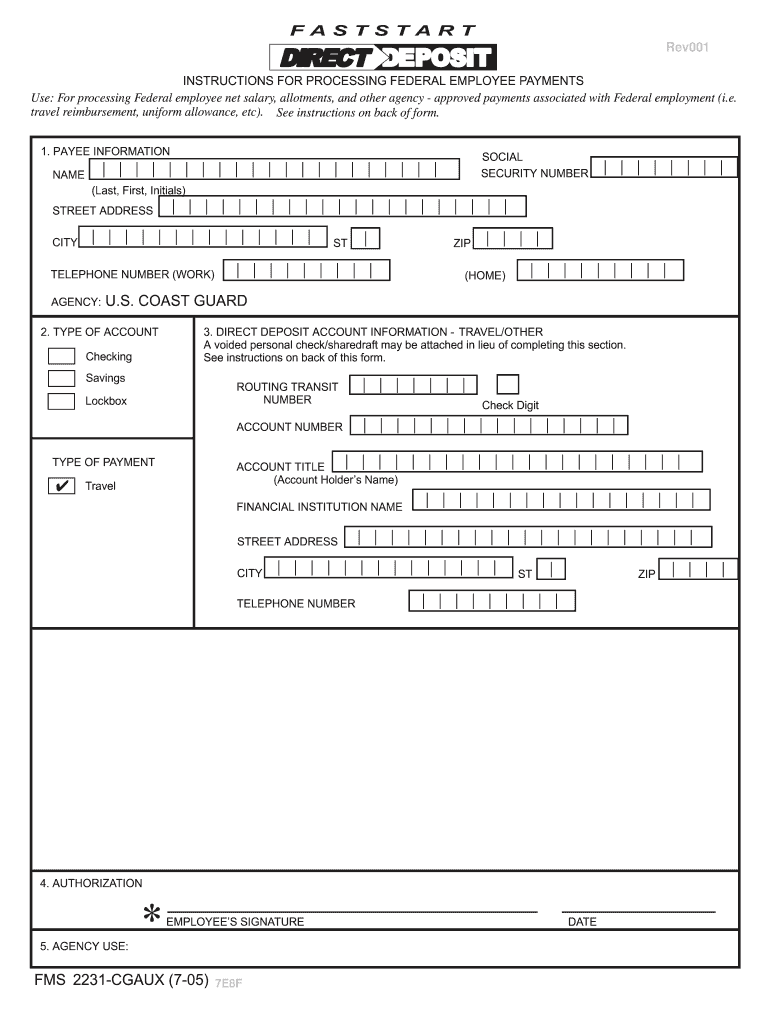

Reset Form F A S T S T A R T DIRECT DEPOSIT Rev001 INSTRUCTIONS FOR PROCESSING FEDERAL EMPLOYEE PAYMENTS Use: For processing Federal employee net salary, allotments, and other agency approved payments

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your fms2231 cgaux form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fms2231 cgaux form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fms2231 cgaux form online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit address street information. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out fms2231 cgaux form

How to fill out form instructions:

01

Start by thoroughly reading the instructions provided with the form. This will give you a clear understanding of the information required and the format in which it should be provided.

02

Gather all necessary documents and information before starting to fill out the form. This includes personal identification, relevant contact information, and any supporting documents that may be required.

03

Begin filling out the form by entering your personal details accurately. This may include your name, address, date of birth, and any other relevant information as specified in the instructions.

04

Follow the instructions carefully while providing the requested information. This may involve checking boxes, selecting options from dropdown menus, or providing written responses in specific fields.

05

Double-check all the information you have entered to ensure accuracy. Any mistakes or inaccuracies may cause delays or complications later in the process.

06

Once you have completed the form, review it again to make sure you haven't missed any sections or fields. Ensure that all required information has been provided.

07

If there are any sections or questions that you are unsure about, seek clarification from the appropriate authority or consult the instructions for further guidance.

08

After filling out the form, sign and date it as required. Some forms may also require additional signatures from witnesses or other individuals, so make sure to comply with those requirements if applicable.

09

Make a copy of the completed form for your records before submitting it as instructed.

Who needs form instructions?

01

Individuals who are filling out a particular form for the first time.

02

People who are unfamiliar with the specific requirements or format of the form.

03

Those who want to ensure that they are providing accurate and complete information as requested.

04

Anyone who wants to avoid errors or complications that could arise from incorrectly filling out the form.

05

Individuals who may not be fluent in the language used on the form and need help understanding the instructions.

06

People who want to ensure that they meet all the necessary criteria and have all the required documentation before starting to fill out the form.

Fill use restrictions : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file form instructions?

Form instructions are generally required for anyone who is filing a tax form. Depending on the form, they may provide instructions on how to fill out the form, what information is needed, and what documents must be submitted with the form.

What is the purpose of form instructions?

Form instructions provide guidance to the user on how to complete the form accurately and efficiently. They explain the purpose of each field and the expected type of information, such as whether a field requires a name, address, or phone number. They also provide tips on how to fill out the form correctly, such as which fields are required and how to correctly format dates. Lastly, form instructions can also provide additional information related to the form, such as what happens if the form is not completed properly or who to contact if there are any questions.

What is form instructions?

Form instructions are guidelines or directions provided to users when filling out a form. They typically explain the purpose of the form, provide step-by-step instructions on how to complete it correctly, and may include additional information or tips. Form instructions help users understand what information is required, how to format it, and where to write or enter it on the form. These instructions aim to make the form-filling process more efficient and ensure accurate and complete submission of the necessary information.

How to fill out form instructions?

When filling out a form, follow these instructions:

1. Read the form: Carefully go through the entire form to understand the information it is requesting and the format required.

2. Gather required information: Collect all the necessary information and documents that the form requests, such as identification, address, employment details, etc.

3. Start with personal details: Begin by providing your personal information, including your full name, date of birth, social security number, and contact details.

4. Provide address information: Fill in your current residential address, including street name, city, state/province, postal/zip code, and country.

5. Employment and income details: This section may ask for your employment details, such as company name, job title, start date, and salary. Ensure you provide accurate and up-to-date information.

6. Follow specific instructions: Some forms may have sections that require specific instructions. These could include providing explanations, checking boxes, or selecting from multiple-choice options. Read and follow these instructions carefully.

7. Use legible handwriting: If filling out a paper form, use clear, legible handwriting to avoid any confusion. Take your time to write neatly and avoid making mistakes or overwriting information.

8. Check for accuracy: Review all the entered details to ensure accuracy and completeness. Double-check spellings, numbers, and dates to avoid mistakes.

9. Attach required documents: If the form requests any supporting documents or identification, make sure to attach them before submitting. Keep copies of any submitted documents for your records.

10. Submit the form: Once you have completed filling out the form, sign and date it if required. Follow the submission instructions provided on the form, such as mailing it, submitting it online, or delivering it in person.

Remember to take your time and carefully follow the instructions while filling out the form to ensure accurate and complete submission.

When is the deadline to file form instructions in 2023?

I apologize, but I need more specific information about the type of form instructions you are referring to. Could you please provide more details?

What is the penalty for the late filing of form instructions?

The penalty for the late filing of form instructions can vary depending on the specific circumstances and the regulations of the relevant jurisdiction. In many cases, there may be monetary penalties imposed for late filing, which can be assessed as a fixed amount or as a percentage of the outstanding tax liability. The penalties may also increase over time for each additional day or month that the filing remains overdue. It is advisable to consult the specific instructions and guidelines provided by the tax authorities or seek guidance from a tax professional to understand the penalties applicable to late filing in a particular jurisdiction.

How can I modify fms2231 cgaux form without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including address street information, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I create an eSignature for the 2231 processing federal fill in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your 2231 federal employee pdf and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit 2231 federal employee fill on an iOS device?

You certainly can. You can quickly edit, distribute, and sign 2231 federal employee template form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your fms2231 cgaux form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2231 Processing Federal Fill is not the form you're looking for?Search for another form here.

Keywords relevant to 2231 instructions form printable

Related to deposit 2231 processing template

If you believe that this page should be taken down, please follow our DMCA take down process

here

.